Cyber Insurance

September 2022

Cyber Insurance

Some businesses think cyber liability insurance is all they need to protect them against digital threats. However, even if they can get coverage, it’s unlikely to pay out if they’re not in compliance with their agreement.

Value Proposition: Cyber Liability Insurance (CLI) is not all your business needs. If you’re able to get a policy, it’s essential to comply with all the requirements in your agreement, otherwise, you could risk losing out on coverage. Learn how we can help you comply with your cyber insurance agreement or get ready to apply for a cyber insurance policy.

Tips/Info

Cyber insurance can help protect your business from financial fallout in the aftermath of a cyberattack, but only if you can prove that you have followed the pre-agreed steps to protect yourself. When was the last time you checked all your safeguards to ensure your business complies with regulatory standards?

An IT service provider like us can help you identify and close any security, backup, and compliance gaps to align you with your insurer’s prerequisites. Contact us today to get started.

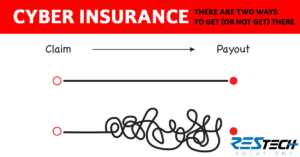

There are two ways to approach cyber insurance. You can invest your time and effort to cut through all the clutter regarding cyber insurance available out there. The second way is to take the guidance of an IT service provider.

A specialist like us, with our expertise and experience, can help you choose the right policy for your business and help you meet your policy’s requirements. Contact us if you need help getting started with cyber insurance.

Even if you have cyber insurance, payouts are not always guaranteed. This is because insurers may exclude specific types of cyberattacks from their policies or contest the claim on the grounds that you fell out of compliance with your policy requirements.

You must carefully review your policy to ensure your business is adequately covered. Need help with this? Contact us today.

Businesses may be denied payouts under their cyber insurance policies for multiple reasons. It could be something as simple as misinterpreting difficult-to-understand insurance jargon. In some cases, businesses may be practicing poor cybersecurity hygiene.

An IT service provider can help you better understand your options and ensure you have adequate security, increasing your chances of receiving a complete payout. Contact us today for help.

If you’re not an expert in cybersecurity, it can be hard to determine which type of cyber insurance is best for your company. If you don’t get adequate insurance coverage, it means you will end up paying the premium and receive nothing in return.

An IT service provider can assess your business and point you in the right direction. Have you ever faced any challenges in getting proper cyber insurance coverage?

A cyber insurance policy could mean the difference between your business surviving the financial turmoil in the aftermath of a cyberattack or going under. However, having cyber insurance isn’t enough; you must also follow the policy requirements to receive a payout.

Our checklist will help you learn everything about cyber insurance basics. Download a free copy.

The majority of insurance policies require you to take specific steps to reduce your risk of a cyberattack. These actions may include adhering to strict security protocols and procedures, regularly backing up data, and more.

An IT service provider can help with all of this, ensuring appropriate security measures are implemented to protect your data and comply with policy requirements. Contact us today to schedule a no-obligation consultation.

To ensure you qualify for a payout from your cyber insurance provider in the event of an incident, you must closely monitor your business processes and other matters agreed upon in your policy agreement.

Not sure how to evaluate your organization’s current posture? Contact us for help.

It’s critical that you read and comprehend your cyber insurance policy terms before agreeing to them. Otherwise, you may find yourself in a situation where your claim is denied even though you’ve paid a premium.

Not sure how to cut through the clutter of cyber insurance? Feel free to contact us today.

You wouldn’t let a teenager drive your car without a robust auto insurance policy. Don’t leave your business without a backup plan in the event of a cyber incident. Don’t hesitate to contact us if you require assistance in finding the best coverage for your needs.

If you want your organization to invest in a policy and receive a payout in the event of a cyber incident, you can’t fall for cyber insurance myths. Read our blog post to learn about the most common myths.

If you are looking for a cyber insurance policy, an IT service provider can help you choose the right one for your business and meet the policy’s requirements. Read our blog post to learn about the benefits of working with an IT service provider on cyber insurance matters.

Cyber insurance is a complex and rapidly changing offering. Several factors influence whether you are protected from financial turmoil in the aftermath of a cyberattack and keeping up with the latest changes can be difficult.

Our blog can guide you through the three main types of cyber insurance you must know about before beginning your cyber insurance journey. Check out the post.

Carefully review your cyber insurance policy to ensure that your business is adequately protected. Check out our blog post to see real-world examples of actual claims that were denied.

Cyber insurance is a vital tool in protecting your business from financial fallout in the aftermath of a cyberattack. However, many insurance providers are reluctant to offer coverage due to the perceived risks. While that may sound like bad news, don’t worry — it’s possible to get and keep coverage.

Check out our infographic to find out how.

Obtaining and maintaining cyber insurance coverage can be difficult for a small business on its own. Do you agree? Share your thoughts below.

Check out our infographic to learn how to navigate this issue.

Cyber insurance can help you recover from financial losses caused by incidents such as cybertheft, data breaches, and ransomware. While obtaining coverage for your company can be difficult, it is not impossible especially if you have an IT service provider assisting you in meeting policy compliance.

Do you want to know how we can improve your chances of getting coverage? Contact us today.

Cyber insurance coverage doesn’t guarantee you a payout if an incident occurs. You might not get the payout you expect if you don’t comply with the requirements set forth by your provider.

Need help ensuring that you receive your payout? Feel free to contact us.